A Financial Analysis of Deferred Grid Modernization and Solar Asset Underperformance

Executive Summary

This report presents a stark financial warning for the Indian economy: the prevailing practice of reactive maintenance in the power sector is not a cost-saving measure but a ticking financial time bomb. By quantifying the “Cost of Inaction,” we reveal that the compounding economic drag from chronic grid instability and the silent degradation of the nation’s solar assets will inflict upwards of ₹15 lakh crore in economic damage over the next decade. This analysis exposes a two-front crisis: a macro-level grid pushed to the brink of failure and a micro-level fleet of solar assets silently bleeding revenue. The findings make an overwhelming financial case for an immediate strategic shift from a reactive to a proactive investment paradigm, demonstrating that the return on investment in grid modernization and predictive asset management is not just positive but essential for India’s economic future.

1. The Twin Crises: A Strained Grid and Ailing Solar Assets

India’s energy landscape is grappling with a two-front war against value erosion. At the macro level, the national grid is buckling under the stress of deferred upgrades and unprecedented demand. At the micro level, individual solar assets—the flagships of India’s green transition—are suffering from preventable, silent decay. This dual crisis represents a massive, and largely unaddressed, drain on the national economy and private investment.

The Macro Crisis: A Grid on the Brink

India’s power grid is being pushed to its operational limits by a perfect storm of internal weaknesses and external pressures. The primary drivers of this systemic instability include:

- High Technical & Commercial (AT&C) Losses: Despite improvements, AT&C losses—a combination of energy theft, billing inefficiencies, and dissipation from aging equipment—remained at a high 16.28% in FY24. In several key states, this figure is substantially higher, placing immense financial strain on distribution companies (DISCOMs).

- Precarious Financial Health of DISCOMs: With accumulated losses reaching a staggering ₹6.77 lakh crore by FY23, state-owned DISCOMs are trapped in a vicious cycle. Their inability to invest in crucial infrastructure upgrades leads to poorer service quality and higher losses, further eroding their financial position.

- Extreme Weather and Demand Surges: Climate change is amplifying the frequency and intensity of heatwaves and cyclones. During the summer of 2024, peak power demand crossed 250 GW, leading to widespread power cuts as infrastructure failed to cope with the surge.

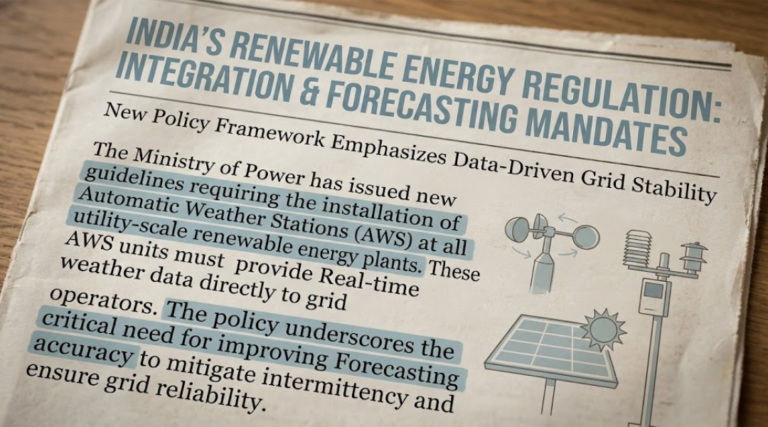

- Volatile Renewable Energy Integration: While crucial for India’s climate goals, the intermittent nature of solar and wind power introduces significant stability challenges to a grid originally designed for consistent, fossil fuel-based generation.

The financial fallout is immense. Unplanned industrial downtime in India costs an estimated ₹70 lakh per hour. For a critical sector like the textile industry in Tamil Nadu, power shortages are estimated to cause daily losses of up to ₹300 crore.

The Micro Drain: Solar Assets in Silent Decay

Parallel to the grid crisis, India’s solar assets are suffering from significant underperformance due to environmental and operational factors unique to the subcontinent. These “silent killers” of performance are eroding investor returns and undermining the viability of gigawatts of clean energy capacity.

- Severe Soiling: High concentrations of dust and particulate matter, particularly in the solar hubs of Rajasthan and Gujarat, can cause annual energy production losses far exceeding global averages—in some cases reaching as high as 25-30%.

- Potential-Induced Degradation (PID): The hot and humid conditions prevalent across much of India create a perfect environment for PID, a phenomenon that can degrade module power output by up to 30% over its lifetime.

- Accelerated Degradation Rates: Research by premier institutions like IIT Bombay confirms that the annual degradation rate of solar modules in India often exceeds the international benchmark of 0.8%, sometimes reaching 1-1.5% per year due to the harsh climatic conditions.

2. Quantifying the Financial Impact: A Multi-Lakh-Crore Liability

To translate these operational challenges into a clear financial liability, this report projects the cumulative economic losses over 1, 5, and 10-year horizons. The data reveals a rapidly escalating financial catastrophe.

Table 1: Projected Economic Losses from Industrial Power Outages in India (Cumulative) (Based on a conservative estimate of affected industrial load and downtime costs)

| Time Horizon | Cost of Disruption (Conservative Scenario) |

| 1-Year | ₹1.15 Lakh Crore |

| 5-Year | ₹6.7 Lakh Crore |

| 10-Year | ₹15.8 Lakh Crore |

The table1 quantifies the projected cumulative economic cost to Indian industries resulting from power outages over 1, 5, and 10-year periods. Based on a conservative estimate, it shows a rapidly escalating financial liability, starting at ₹1.15 lakh crore in the first year and ballooning to ₹15.8 lakh crore over a decade, highlighting the severe and growing economic damage caused by an unstable power grid.

This visuals represents the data from Table 1, illustrating the projected cumulative economic losses for India’s industrial sector due to power disruptions across 1, 5, and 10-year horizons. The escalating height of the bars emphasizes that the financial impact grows at an accelerating, non-linear rate, transforming chronic grid instability into a compounding national liability of immense proportions.

Table 2: Cumulative Revenue Loss from Undetected Faults (100 MW Solar Plant in India) (Based on India-specific degradation rates and solar tariffs)

| Time Horizon | Revenue Loss from Soiling (7%) | Combined Technical Loss* (3%) | Total Cumulative Revenue Loss |

| 1-Year | ₹2.45 Crore | ₹1.05 Crore | ₹3.5 Crore |

| 5-Year | ₹13.0 Crore | ₹5.6 Crore | ₹18.6 Crore |

| 10-Year | ₹27.5 Crore | ₹11.8 Crore | ₹39.3 Crore |

This table 2 details the cumulative revenue loss for a representative 100 MW solar power plant in India over 1, 5, and 10 years due to common operational issues. It specifically breaks down the financial impact of a 7% annual energy loss from soiling (dust and particulate matter) and a 3% loss from other combined technical faults. The data demonstrates how these seemingly minor, persistent issues compound over time to create a significant total revenue loss of ₹39.3 crore over a decade.

This stacked bar chart breaks down the cumulative revenue losses for a single 100 MW solar plant, as detailed in Table 2. It visually separates the financial impact of soiling from other combined technical losses over 1, 5, and 10 years. The chart effectively demonstrates how these individual, often unaddressed faults silently erode crores in revenue, progressively damaging investor returns and the long-term financial viability of the asset.

3. The Investment Imperative: An Overwhelming Return on Action

The sheer scale of these hidden costs makes a powerful case for proactive investment. The analysis shows that the return on investment (ROI) from modernizing India’s energy systems is not just positive—it is transformative.

- For the National Grid: The National Electricity Plan estimates an investment of ₹33.6 lakh crore (US$384.5 billion) is required over the next decade. While substantial, this investment would prevent economic losses projected to be many times that amount, yielding a profound net benefit to the Indian economy.

- For a 100 MW Solar Plant: A 10-year investment in proactive Operations & Maintenance (O&M), including advanced monitoring and robotic cleaning, is estimated at ₹6-8 crore. This investment would prevent over ₹39 crore in lost revenue, delivering an implied ROI of over 400%.

This graph presents the central financial argument of the report through a direct visual comparison of the costs versus the benefits of proactive investment over a 10-year period. It juxtaposes the significant “Cost of Inaction” (represented as “Benefit/Avoided Loss”) against the much smaller “Cost of Action” (the required investment) for both national grid modernization and individual solar plant maintenance. The stark difference in the bars visualizes the overwhelming return on investment (ROI), framing proactive spending not as an expense, but as a high-return strategic necessity.

A New Approach is on the Horizon

At Enercog, we recognize that the true cost of energy inaction is measured in crores of rupees slipping through the cracks of neglect. The era of reactive firefighting is over, and the future demands a fundamental shift towards intelligent, predictive, and optimized energy management.

We believe that India doesn’t just need more energy—it needs smarter energy. That is why we are pioneering new solutions to address this multi-lakh-crore challenge head-on.

Stay tuned as we prepare to unveil a new paradigm in energy management.

Enercog: Powering the Future with Intelligence.

Conclusion: A Costly Choice

The conclusion is stark and unavoidable: inaction is a choice, and for India, it is an exceptionally expensive one. The compounding liabilities from a fragile grid and underperforming assets pose a direct threat to the nation’s economic growth and energy security. The shift from a reactive to a proactive mindset in the energy sector is not a matter of preference but an urgent economic and strategic imperative. The future stability of India’s grid and the profitability of its vast renewable assets depend entirely on the investment decisions made today.